With regards to the financial plan, everybody has their feedback to contribute. However regularly the advice can be deceiving or wind up causing more damage than great. In this article, we have tried to list down the biggest Personal Finance mistakes that a considerable lot of us submit.

1. Spending beyond what you can afford

One of the most costly financial blunders you can make is overspending. It doesn’t appear to be anything to joke about assuming you are spending a couple of additional bucks consistently on requesting food or purchasing garments you don’t need; yet, multiply this amount by 52, and that is the amount that you are wasting each year!

If you can save even 50% of this and add it to your investment funds, you can make savings for yourself for a stormy day. Having a month-to-month budget is essential.. Otherwise, you will wind up overspending. Additionally, the effectively available credit cards have made it simpler to spend beyond what we can afford. Therefore, you must forgo swiping your card however much you can.

2. Investing issues

While most Indians are great savers, contributing is another story through and through. Standing by too long to even think about beginning contributing is a problem that everyone has experienced. Many possibly investigate their financial preparations and investing when they’re in their 30s or even 40s. Yet the earlier you start, the more you can profit from the force of compounding.

3. Mutual funds issues

Indians have at long last woken up to the temperance of common assets with growth strategies (SIPs). Be that as it may, a significant number of them are not doing it right. Having less awareness about these topics such as mutual funds, SIP, etc. is also a crucial factor for leading to financial problems. Therefore, you must get the right counseling and do extensive research on this topic for the best results.

4. Excessive purchase

Purchasing your own home is one of the main financial choices that you will make in the future. In any case, it is important to see the amount you can afford to spend on your home. A home loan is probably the biggest obligation that you can bring. Also, making the right choice to put resources into your home ought to be taken when you have sufficient reserve funds. Also, you must understand that if you can pay your month-to-month home loan EMI effortlessly. However, if you don’t have a home loan, you will be less anxious and will not need to shave off a piece of your month-to-month salary in EMIs.

Final Words

Organizers likewise cite issues like not having legitimate nominations and a Will. This leads to a botch of financial documents as a common problem. In the unfortunate case of a sudden demise, these variables could escalate into a crisis.

However, you can fix a large portion of your finances easily. But, the longer you hold back to do as such, the more your long-term accounts will suffer. To begin breaking down your own money, you must analyze the mistakes you may be committing. In this way, you can begin rolling out the necessary improvement.

- SITEX – Surat International Textile Expo 2026by Editor

- India Travel Mart 2026 – Chandigarh: Unlocking New Opportunities in Travel & Tourismby Editor

- MahaBharat International Trade Expo 2026 – India’s Grand Platform for Business, Retail & Innovationby Editor

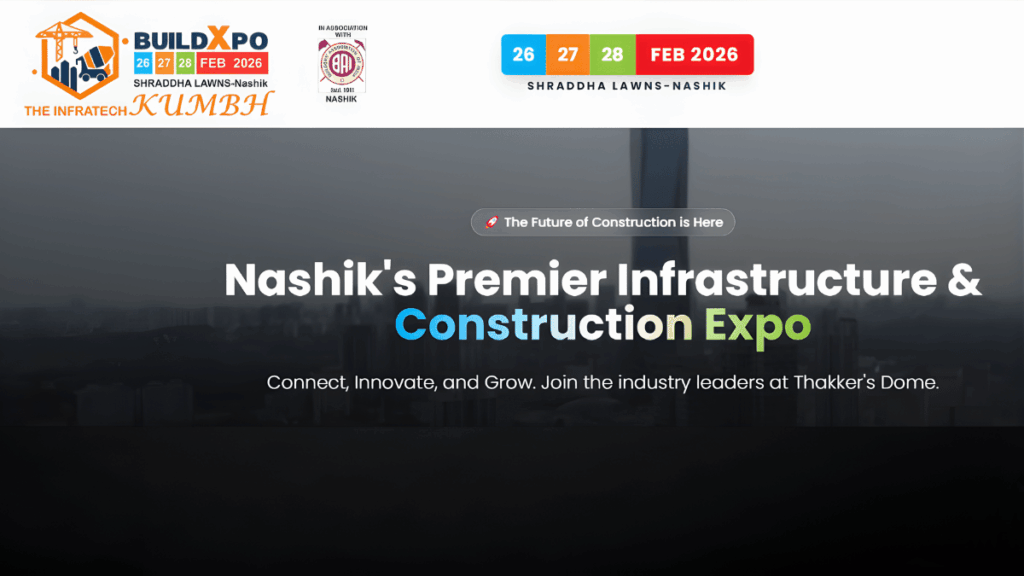

- BuildXpo 2026 – Nashik’s Premier Construction and Infrastructure Exhibitionby Editor