UFI Global Exhibition Barometer Reveals Industry Is Poised for Robust Growth in 2024

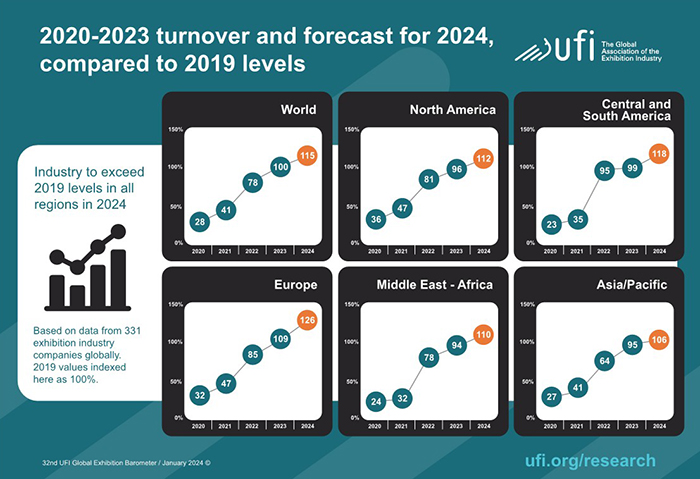

Global exhibition revenues on average are projected to reach a comparable level to 2019, growing by an average of 15% compared with 2023 revenues, according to the the findings of the latest UFI, The Global Association of the Exhibition Industry Global Exhibition Barometer, the association’s biannual flagship report designed to take the pulse of the worldwide exhibition industry.

“Our report shows that the exhibition industry hasn’t just reached pre-pandemic levels in 2023 but is also planning to grow in 2024, and many new jobs in exhibitions are coming up around the world,” said Kai Hattendorf, managing director and CEO of UFI. “This good news comes in parallel with shifts of business priorities, where economic and environmental considerations show significant progression.”

He added that as the industry navigates through evolving challenges and opportunities, the focus on digital transformation, economic resilience and sustainability heralds a dynamic phase of growth and innovation for the global exhibition sector.

Here are Eight Highlights from the 32nd Edition of the Report:

- Surpassing Pre-Pandemic Revenues: In 2024, the exhibition industry is expected to witness a 15% increase in revenues, reaching 115% of the pre-pandemic average globally. This growth trajectory positions the sector to record its highest-ever revenfigures next year, according to UFI officials.

- Workforce Expansion: Globally, 52% of companies said they plan to expand their workforce in the next six months, with 45% focused on maintaining current staff levels. The highest proportion of companies planning to add staff are in Saudi Arabia (100%), the UAE (82%), India (80%), Greece (73%) and Malaysia (67%), according to the report.

- Focus Returns to Global and Local Economic Developments: The most pressing business issue respondents cited in all regions and most markets was economic factors, comprising 40% of answers. Twenty-two percent of global companies cited the “State of the economy in their home market” as their top concern (compared with 14% six months ago), followed by “Global economic developments” at 17% (compared to 12% six months ago) and “Geopolitical challenges at 12%.

- Growing Influence and Impact of AI: Marking a growing recognition of AI technology’s transformative influence on the industry, a significant 91% of companies acknowledged that generative AI will have an impact, up from 87% in the previous edition of the report. Underscoring the potential of generative AI in reshaping industry operations and strategies, the report also delved into areas expected to be most affected: sales, marketing and customer relations and research and development (both 80%), and event production (65%) – areas where generative AI applications are already being used.

- Regional and Global Insights: Covering 419 companies across 61 countries, the report highlights diverse recovery and growth patterns. For example, revenue recovery in 2023 varied significantly, from 127% in India to 80% in Thailand, compared to 2019 levels. The outlook for 2024 remains positive across different regions, with India and Greece leading in anticipated revenue growth.

- Operational Recovery: Most companies reported an increase in operational activities in the second half of 2023, with a consistent upward trend in activities across regions, from 77% in the Middle East and Africa to 57% in North America. This growth trend is expected to continue in 2024, with a percentage of companies reporting an increased activity ranging from 66% in North America to 64% in the Middle East and Africa, 55% in Asia/Pacific and 54% in Central and South America and Europe, respectively.

- Uptick in Profit and Turnover Optimism: About half of the surveyed companies reported a more than 10% increase in operating profits for 2023 compared to 2019, with a positive outlook for 2024 revenues expected to grow by 15% on average. These general trends varied from one country to the other, with the countries declaring the highest proportion of companies expecting a more than 10% profit increase (compared to 2019) located in the UAE (91%), Saudi Arabia (80%), India (71%), Brazil (67%) and Mexico (64%), according to the report.

- Evolving Business Issues: The landscape of pressing business issues has shifted, with economic concerns taking precedence over previous focal points. “Internal management challenges” (10%) and “Impact of digitalization” (6%), which were the top two issues six months ago, are now also preceded by “Competition from within the exhibition industry” (11%) and “Sustainability/Climate” (10%).

Why it Matters

This latest edition of UFI’s bi-annual industry survey was concluded in January 2024 and includes data from 419 companies across 61 countries and regions. The study also includes outlooks and analysis for 19 focus countries and regions – Argentina, Australia, Brazil, China, Colombia, France, Germany, Greece, India, Italy, Malaysia, Mexico, Saudi Arabia, South Africa, Spain, Thailand, the UAE, the UK and the U.S. – as well as five additional aggregated regional zones. Research for the Barometer was conducted in collaboration with 31 UFI member associations across the globe.

The report also highlighted significant shifts compared to the previous edition of the Barometer, as well as an analysis of the top business issue trends over the 2016-2024 period.

The next UFI Global Exhibition Barometer survey will be conducted in June 2024. Download the full 2024 report here.